Paying taxes in Italy often requires using the F24 form. It is the standard way to pay a wide range of taxes and contributions. From IMU (property tax) to car tax, and even income tax balances. For foreign buyers or residents, understanding how this form works is essential to avoid mistakes.

👉 For a broader overview of Italian rules and paperwork, see our article: Italian Bureaucracy and Everyday Life: A Guide for Foreigners.

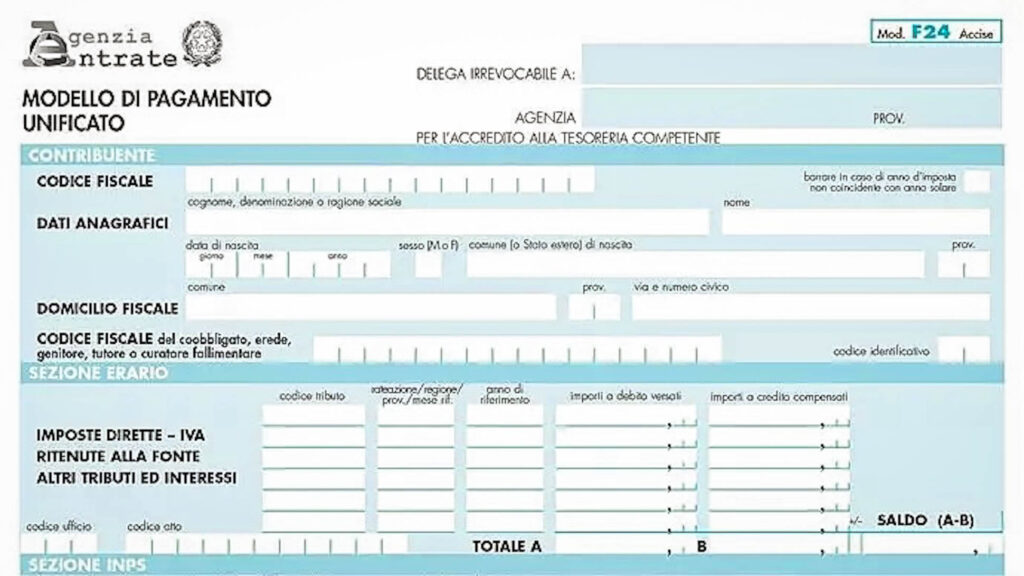

What Is the F24 Form?

The F24 form is a unified tax payment document introduced to simplify the Italian tax system. Instead of having different forms for each type of tax, the F24 allows you to pay multiple taxes at once with a single operation.

Types of payments that go through F24 include:

- IMU (municipal property tax)

- TARI (waste tax)

- Bollo auto (car tax)

- Social security contributions (INPS)

- IRPEF (income tax) balances and advances

How to Get the F24 Form

You can obtain an F24 in different ways:

- Download it online from the Agenzia delle Entrate website.

- Banks and post offices provide paper versions.

- For residents with a SPID or CIE, online services allow direct compilation and payment.

How to Fill It Out

The F24 is divided into several sections:

- Personal information (name, codice fiscale, residence).

- Tax codes (codici tributo) – specific numeric codes that identify the tax you’re paying (e.g., “3912” for IMU).

- Amount due and the relevant municipality/province code if applicable.

Mistakes in codici tributo are common. It’s a good idea to confirm them with your accountant (commercialista), the Agenzia delle Entrate, or directly on the municipality website.

How to Pay the F24

- In person at a bank, post office, or through an authorized tabaccheria.

- Online via your bank’s website if you have home banking.

- Directly through Agenzia delle Entrate services (requires SPID/CIE login).

Payments are processed in real time, and you receive a receipt as proof.

Deadlines and Penalties

Late payments generate penalties and interest. If you miss a deadline, you can use the ravvedimento operoso procedure (a form of voluntary correction) to reduce fines by paying promptly.

Conclusion

The F24 form is unavoidable for homeowners, residents, and anyone with financial obligations in Italy. Learn how it works early on to avoid confusion, penalties, and wasted time.